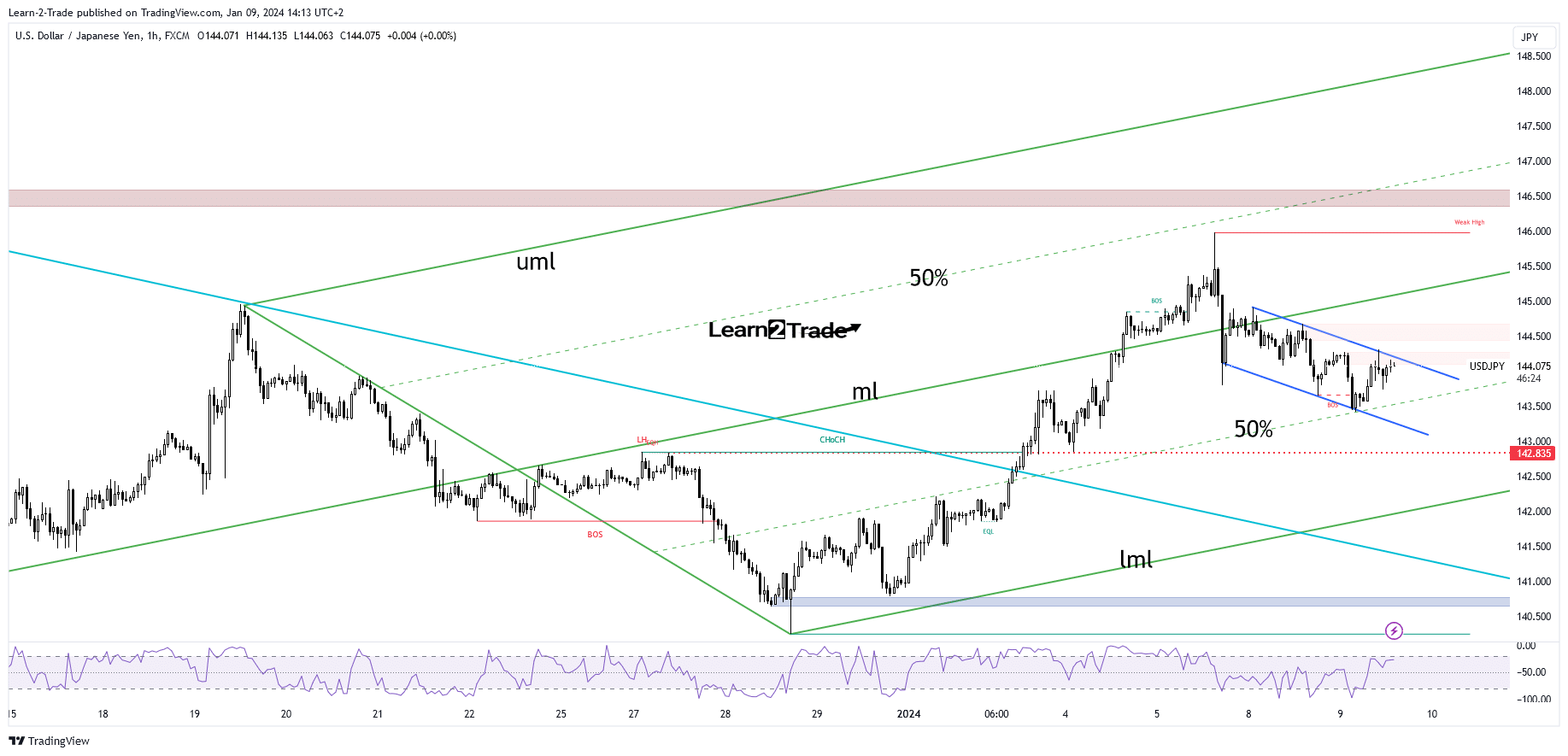

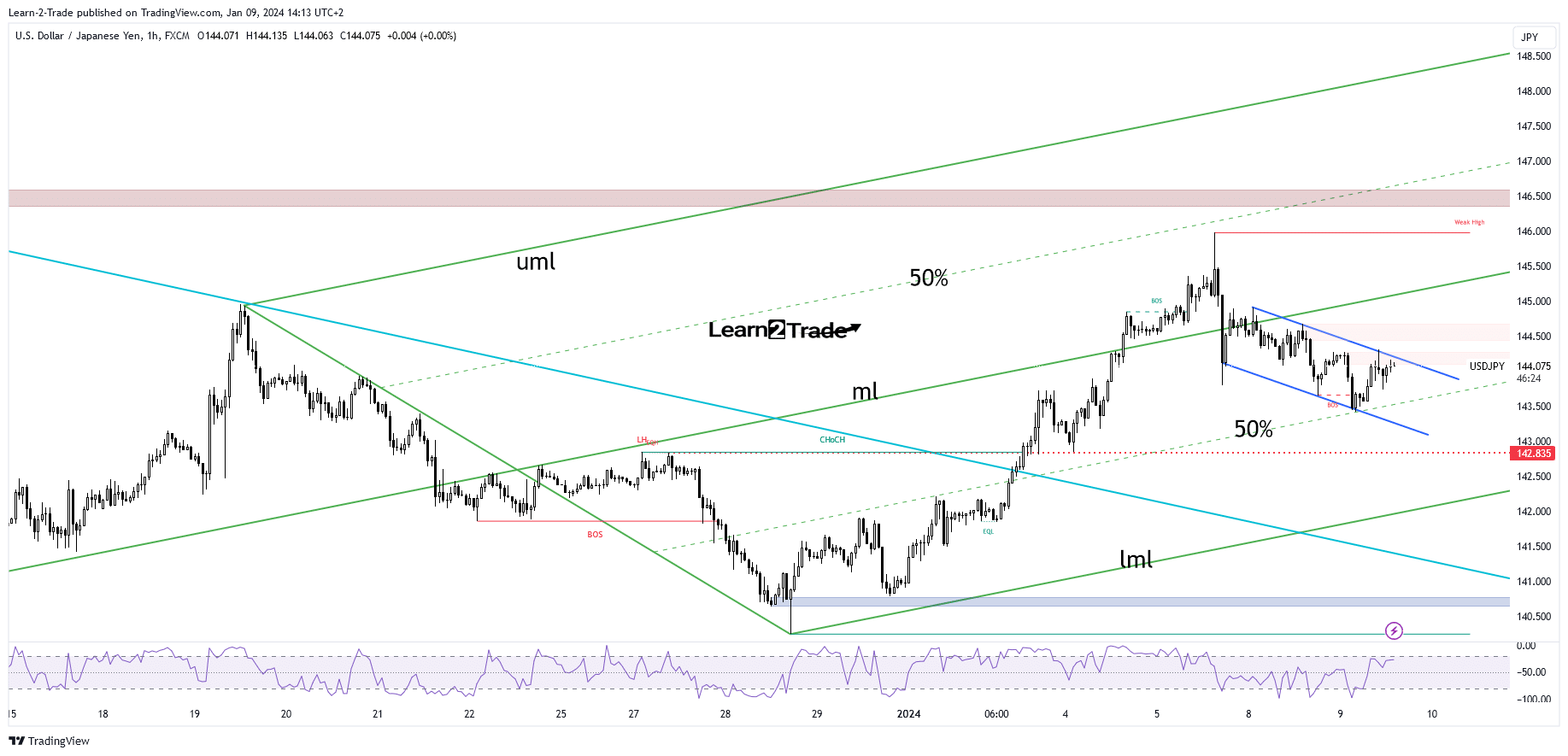

- Activating the flag pattern indicates more gains.

- The new lower low reverses the upside scenario.

- A pullback above the midline (ml) signals a larger move to the upside.

USD/JPI fell slightly in the short term as the US dollar remained under pressure. The pair is trading at 144.07 at the time of writing. The outlook appears neutral, with no directional bias.

–Are you interested in learning more about MT5 brokers? Check out our detailed guide-

The dollar was in a brief correction even though US NFP, average hourly earnings and the unemployment rate were better than expected. Yesterday US consumer credit reached 23.8B, above expectations of 8.9B.

Tokyo Core CPI reported a rise of 2.1% today, in line with expectations, while household consumption fell 2.9%, beating expectations for a 2.2% decline.

Later, the US will release a trade balance indicator, which is expected to come in at -64.9B versus -64.3B in the previous reporting period.

The US dollar depreciated a bit, but it could take the lead again because the US consumer price index m/m and CPI on an annual basis could announce higher inflation in December compared to November.

Inflation data should move markets on Thursday. The Fed is expected to cut the federal funds rate in 2024, but higher inflation could delay such decisions.

USD/JPI price technical analysis: 50% Fibonacci as key support

The USD/JPI price developed a minor flag pattern. The bias remains bullish in the short term as long as it is above the 50% Fibonacci line of the ascending villa. A breakout to the upside and the activation of a flag formation indicate a continuation to the upside.

–Are you interested in learning more about Telegram Groups for Forex Signals? Check out our detailed guide-

However, only retracing above the midline (ml) and making a new higher high confirms more growth. On the contrary, removing the 50% Fibonacci line and creating a new lower low confirms more declines.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money