- The bottom pressure remains high as long as it is below the upper mean line.

- Removing a pivot point activates more drop.

- Figures from the US and Japan could have a significant impact tomorrow.

The price of USD/JPI fell to just 147.70 today, where it has found demand again. It has now turned upside and is trading at 147.98 at the time of writing.

–Are you interested in learning more about ETF brokers? Check out our detailed guide-

The pair weakened as the US dollar lost strength from a one-week peak. After yesterday’s sell-off, the pair is recovering.

Yesterday, Japan’s average cash earnings and household consumption were worse than expected, while the US RCM/TIPP economic optimism was lower at 44.0 points compared to forecasts of 47.2 points.

Today, Japan’s leading indicators reached 110.0%, above the estimated 109.4%. On the other hand, the trade balance could jump from -63.2B to -62.0B. The dollar needs strong support from the US economy to bounce back higher.

Tomorrow, Japan will release current account, bank lending and economic watchdog sentiment, while the US will release jobless claims and final wholesale inventories. Only better-than-expected Japanese data could help the yen extend its near-term gains.

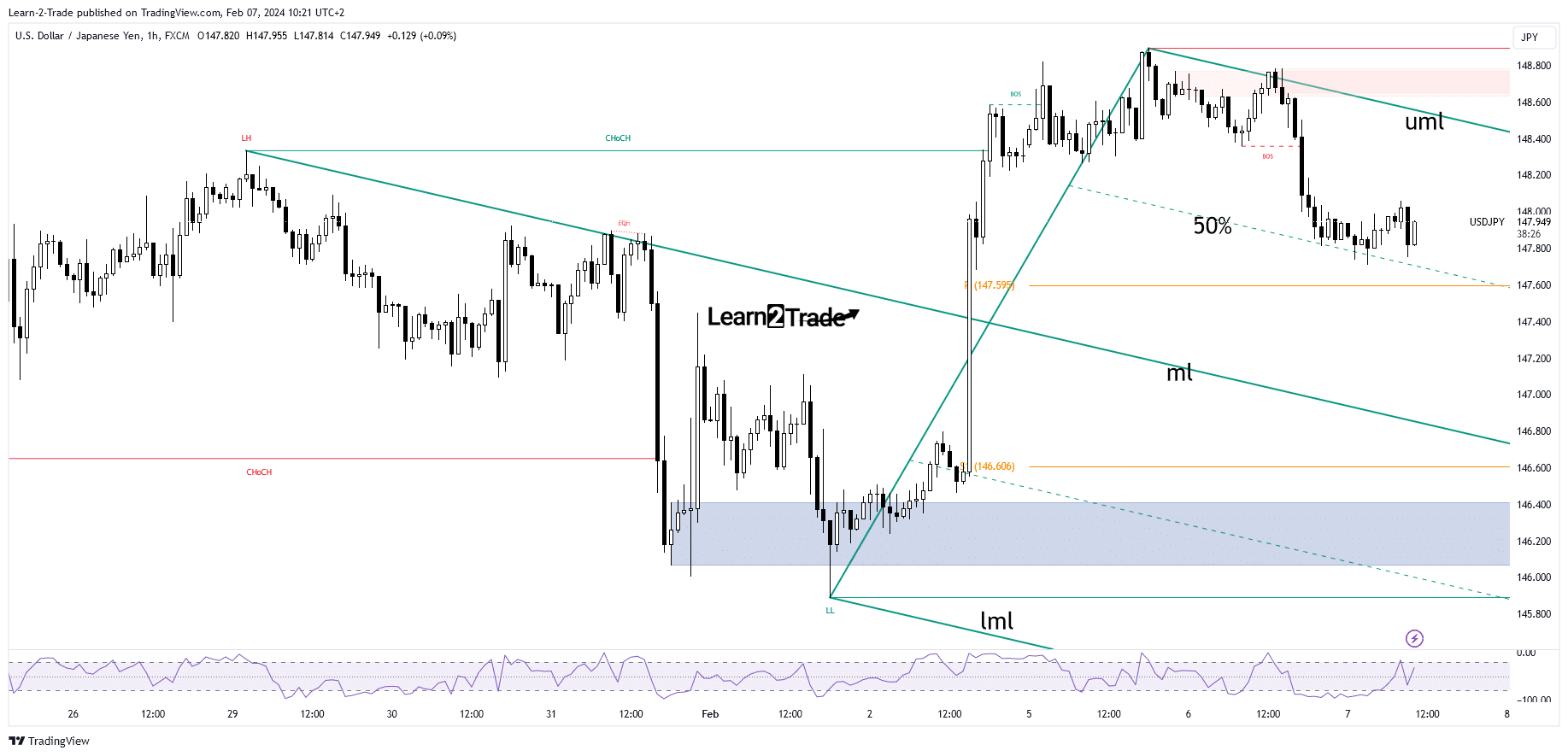

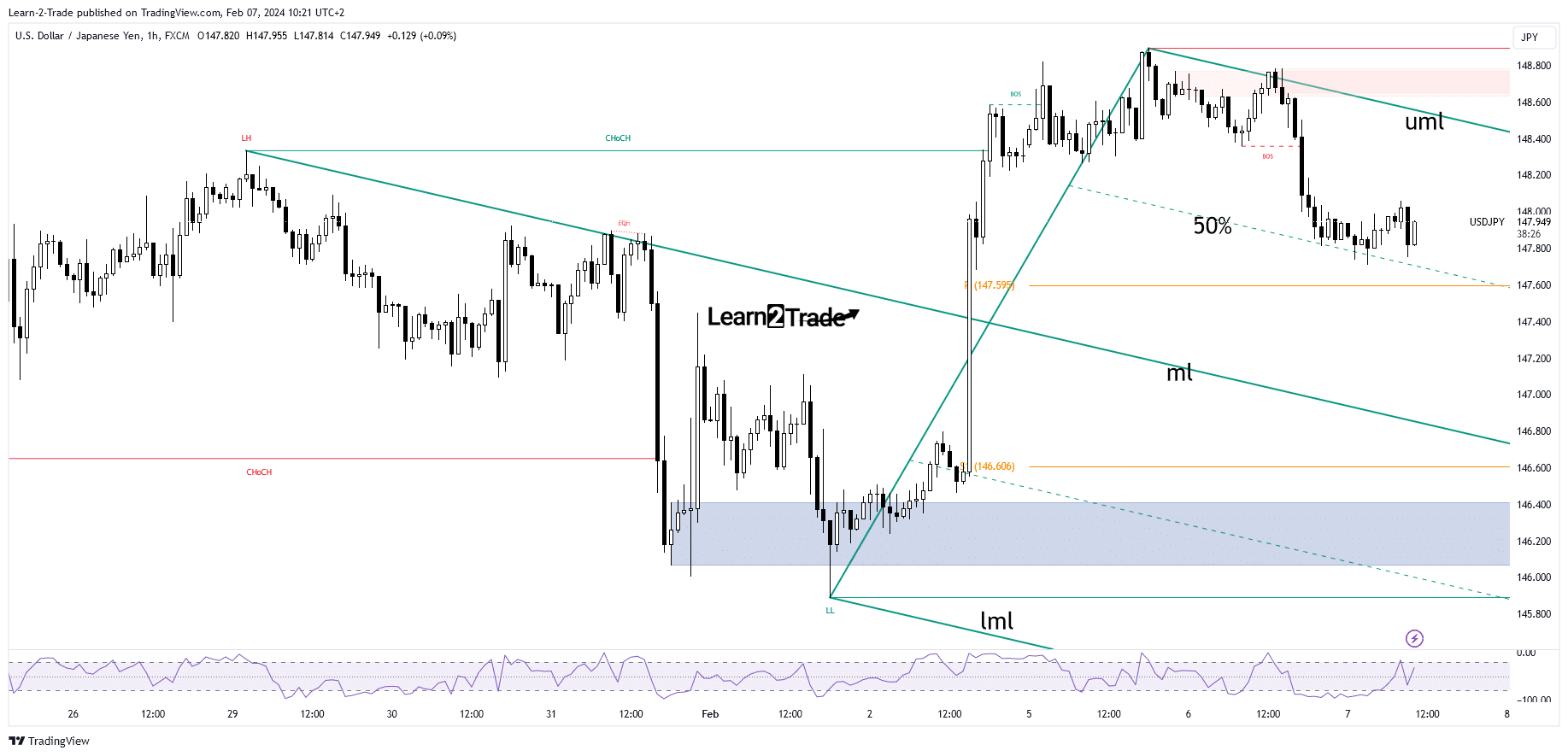

USD/JPI Price Technical Analysis: Support at 50% Fib

From a technical point of view, the price of USD/JPI turned to the downside after failing to clear the former high of 148.82. It fell after a retest of the upper middle line (uml) of the descending forks.

–Are you interested in learning more about Canadian forex brokers? Check out our detailed guide-

It has now found support at the 50% Fibonacci descending fork line, signaling exhausted sellers. It failed to reach the weekly pivot point of 147.59, indicating a potential pullback.

However, the price could fall deeper if it remains below the upper median line. However, just taking the 50% Fibonacci line and the hang point confirms more declines towards the midline (ml).

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money