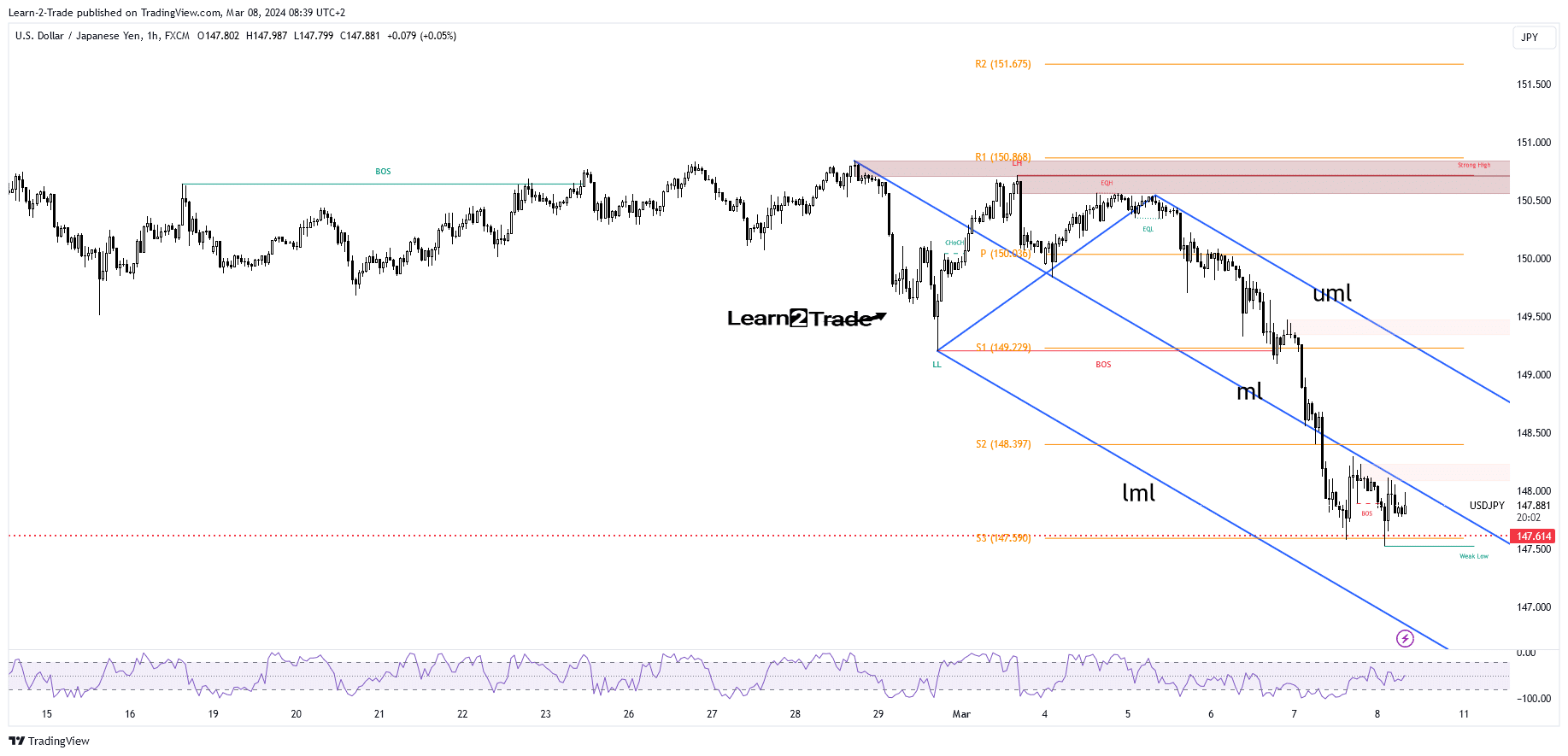

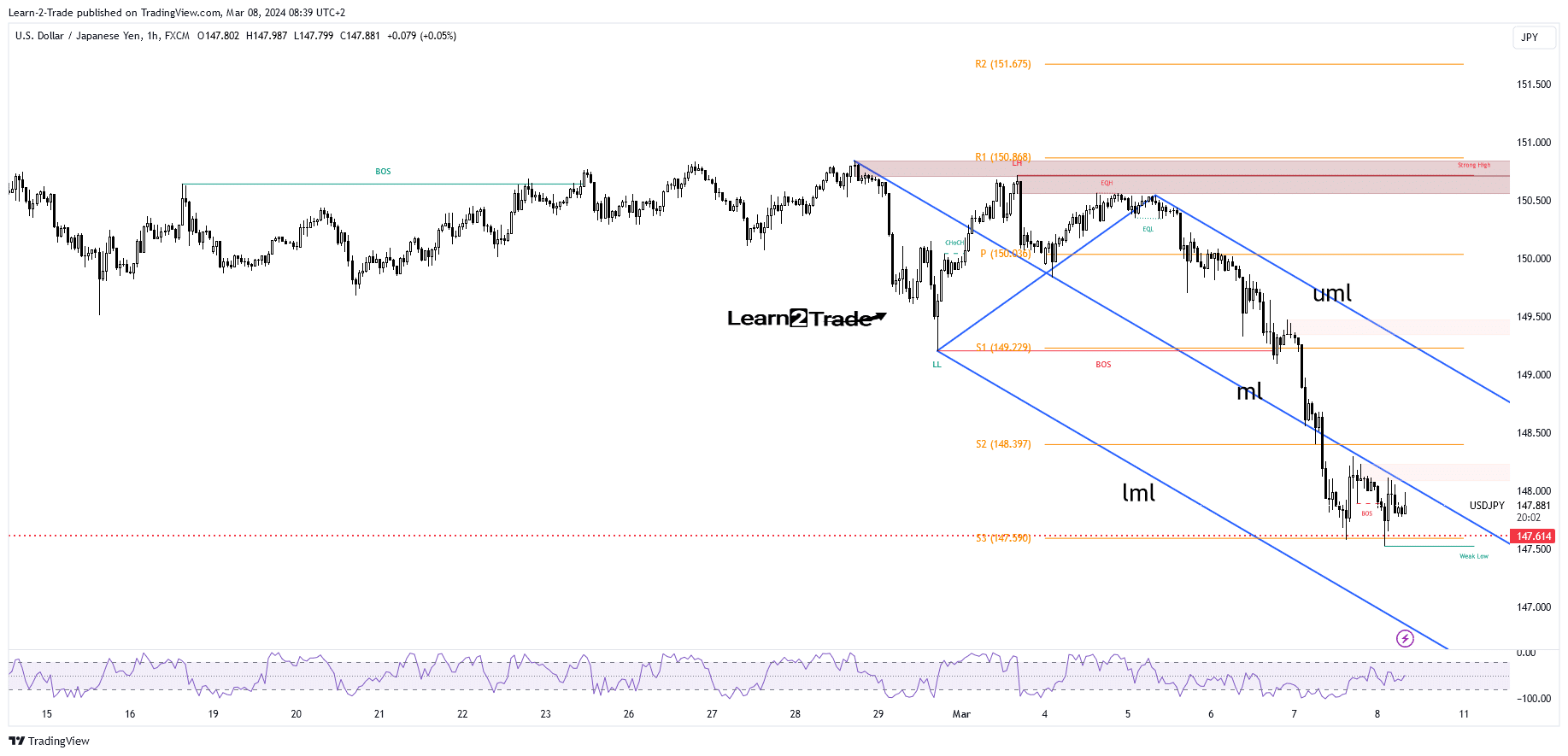

- The USD/JPI bias remains bearish if it remains below the midline (ml).

- A new lower low triggers more dips.

- US data could change the mood today.

USD/JPI saw a huge drop on Thursday as the US dollar weakened. Meanwhile, the Japanese Yen got a boost from the BoJ’s hawkish comments. The pair is trading at 147.88 at the time of writing, above today’s low of 147.52.

–Are you interested in learning more about CFD brokers? Check out our detailed guide-

Low pressure is still high, so a deeper drop is still in the cards. Dollar falls sharply after Fed Chairman Powell’s testimony. The ECB left monetary policy unchanged yesterday as expected but failed to change sentiment.

Today, Japanese economic data was mixed. Economy Watchers sentiment was reported at 51.3 points, above expectations of 50.6 points. Leading indicators reached 109.9%, above the expected 109.7%, and the current account jumped from 1.81T to 2.73T, above the estimated 2.07T. Bank lending grew by 3.0% less than the forecasted growth of 3.2%, while household consumption recorded a decline of 6.3%.

US data should be decisive and could change sentiment today. The change in employment excluding agriculture is expected to amount to 198 thousand. Average hourly earnings could see growth of 0.2%, while the unemployment rate could remain at 3.7%.

USD/JPI price technical analysis: In a range below 148.00

Technically, the bias remains bearish as long as it is below the median line of the descending forks (ml). The sell-off is paused at 147.61 below the barrier (historical level). It registered only false failures, signaling exhausted sellers. Staying above this static support and moving back above the midline (ml) may herald a new bullish momentum.

–Are you interested in learning more about MT5 brokers? Check out our detailed guide-

A new lower low, which removes the 147.61 level, triggers more declines. The psychological level of 147.00 represents a potential target if the rate continues to decline.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.