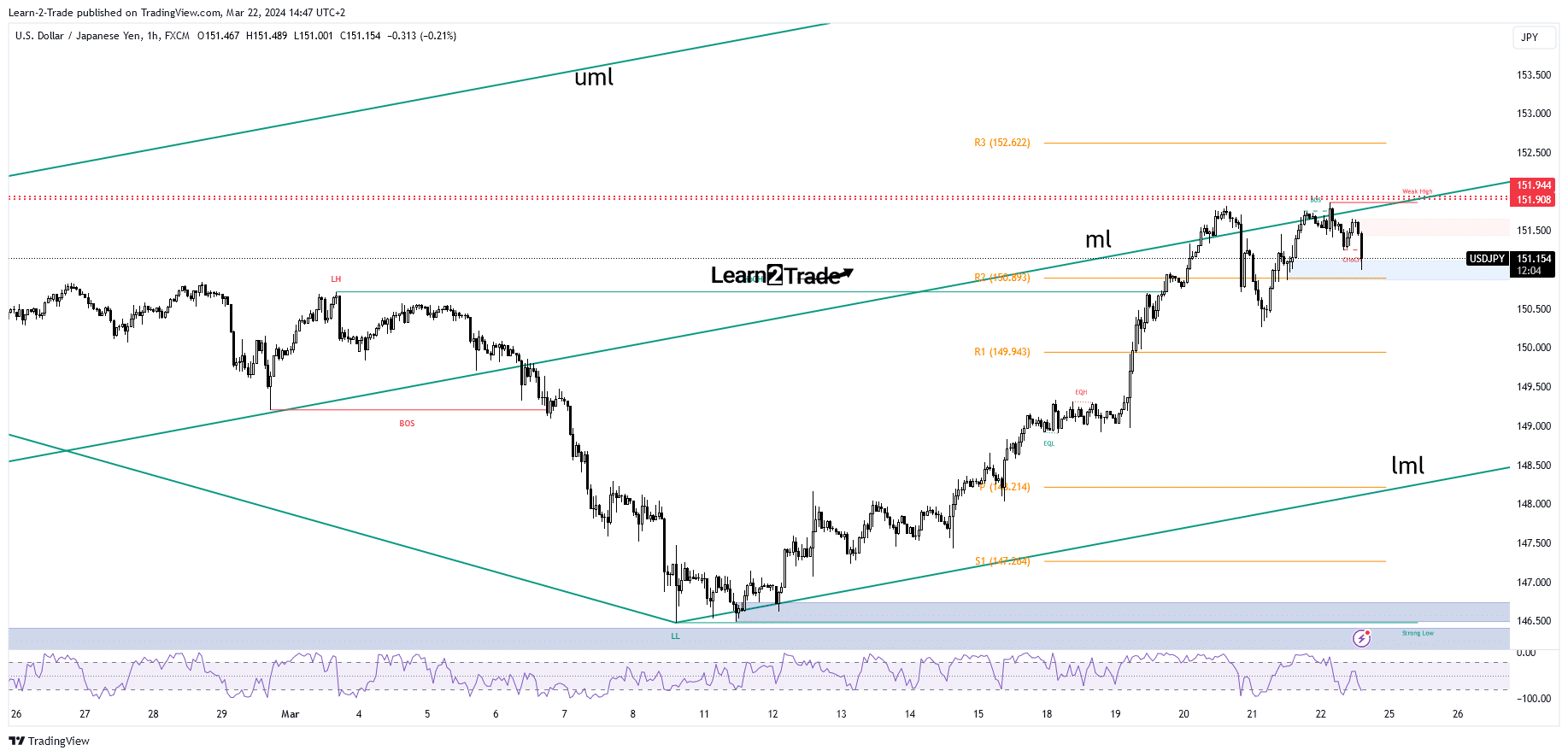

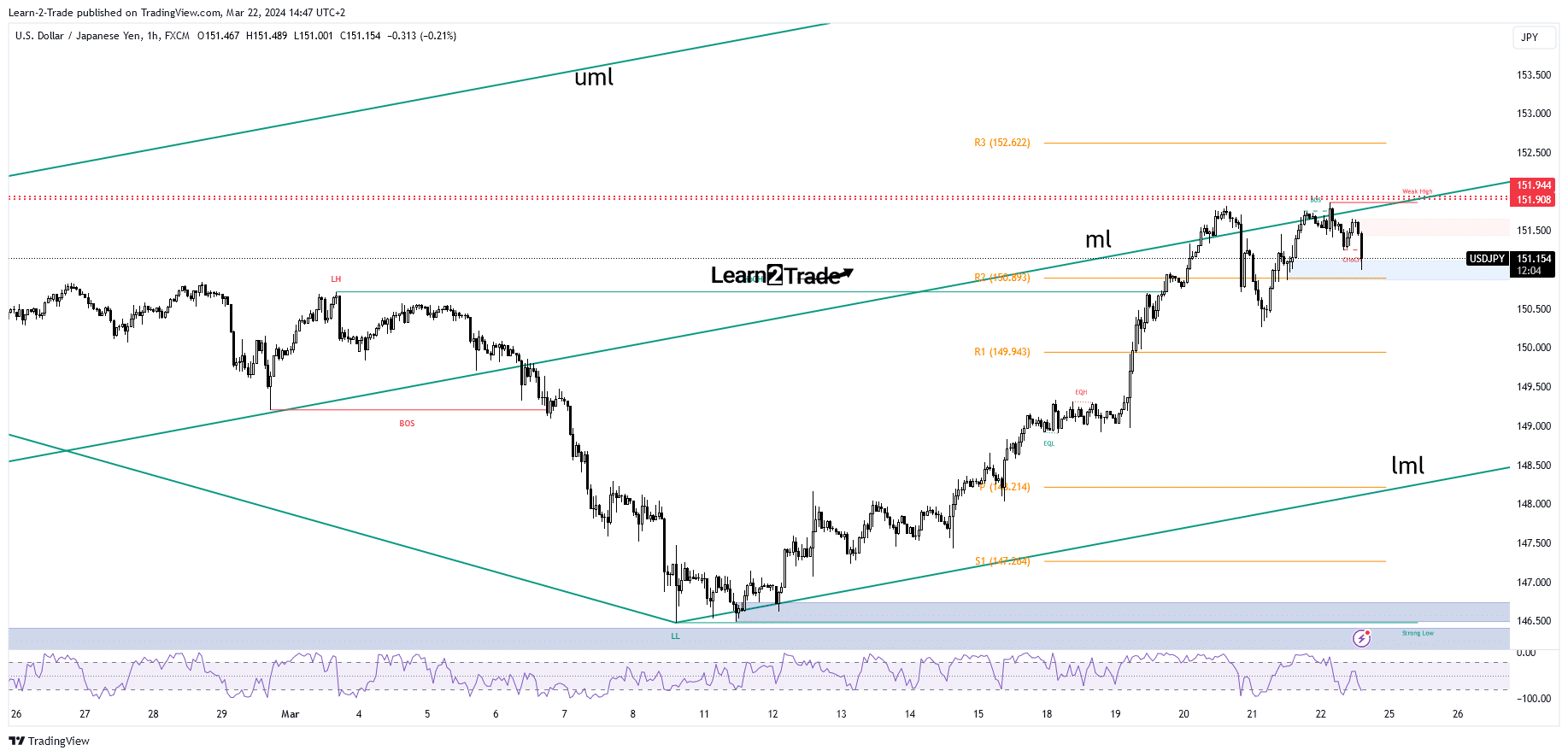

- The bias remains bullish as long as it is above R2.

- A new higher high activates further growth.

- Failure to stay above the middle line (ml) can reveal exhausted buyers.

USD/JPY was little changed on Friday, hovering near 151.00 at the time of writing. The bias remains bullish, with continued upside more likely. However, prices may experience a correction amid profit taking.

-Are you interested in learning more about Bitcoin price prediction? Click here for details –

The dollar dominated the currency market as the dollar index marked new weekly highs.

Yesterday, Japan’s trade balance and Flash Manufacturing PMI were better than expected, while the nation’s core CPI was in line with today’s expectations.

On the other hand, the dollar remains bullish, although the US released mixed data. The Flash Services PMI came in at 51.7 versus expectations of 52.0, confirming a slowdown in expansion. The Flash Manufacturing PMI jumped from 52.2 to 52.5, above expectations of 51.8, while jobless claims came in at 210,000 last week, up from 212,000 in the previous reporting period.

Furthermore, existing home sales, the CB leading index, the current account and the Philly Fed manufacturing index were also better than expected.

Today, Canadian retail sales and core retail sales came in better than expected and could help the dollar continue its appreciation despite minor declines.

USD/JPI price technical analysis: Strong bullish pressure

Technically, the USD/JPI price bounced above the midline of the rising villa (ml), but again failed to stay above this dynamic resistance, signaling buyer exhaustion.

-Are you interested in learning more about the Forex Signal Telegram Group? Click here for details –

151.90 and 151.94 represent static resistance levels. However, the bias remains bullish as long as it is above the psychological level of 151.00 and the R2 of 150.89.

A new lower low could trigger further declines. On the contrary, taking the middle line (ml) and 151.94 confirms an upward continuation.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.