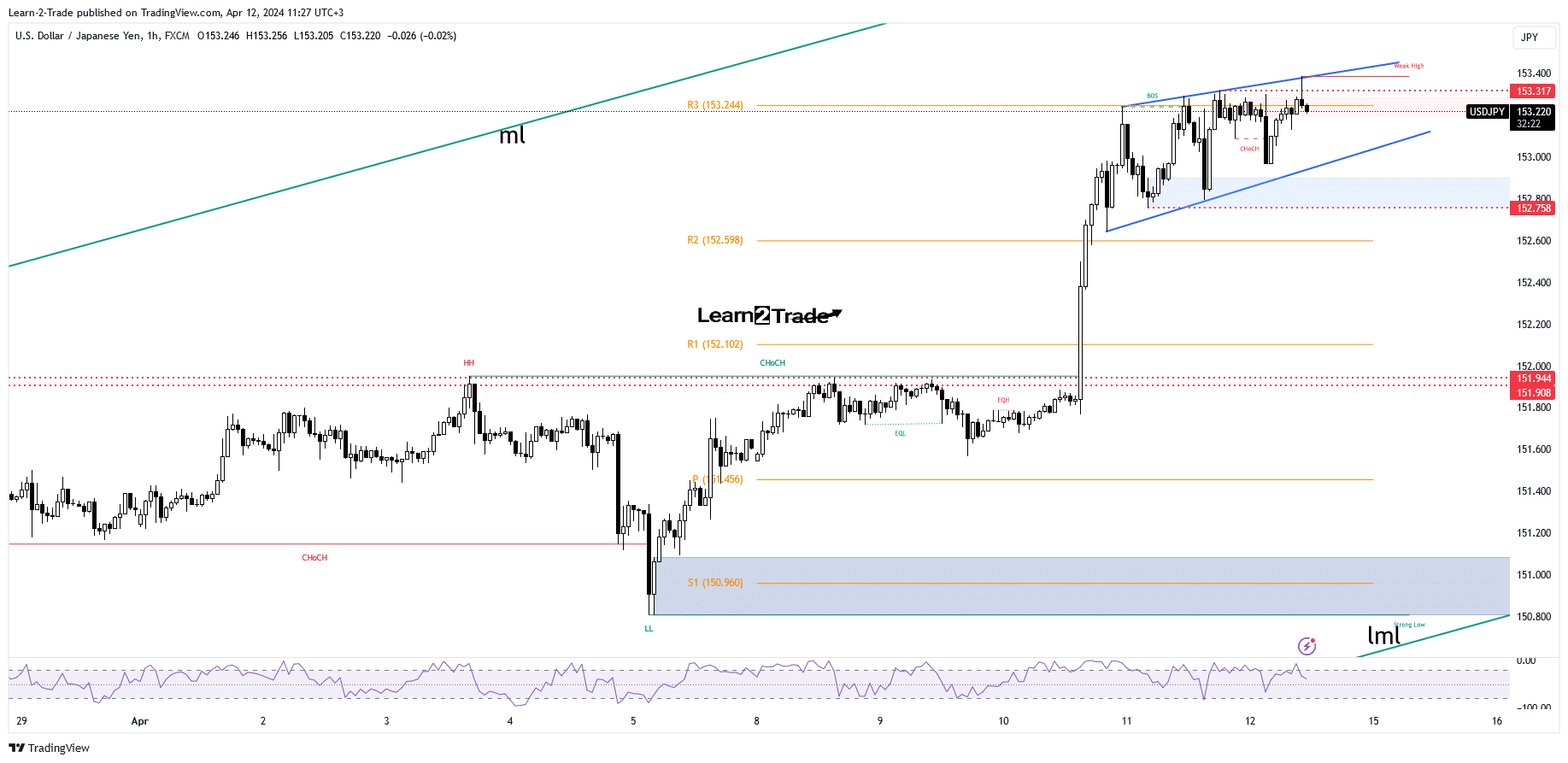

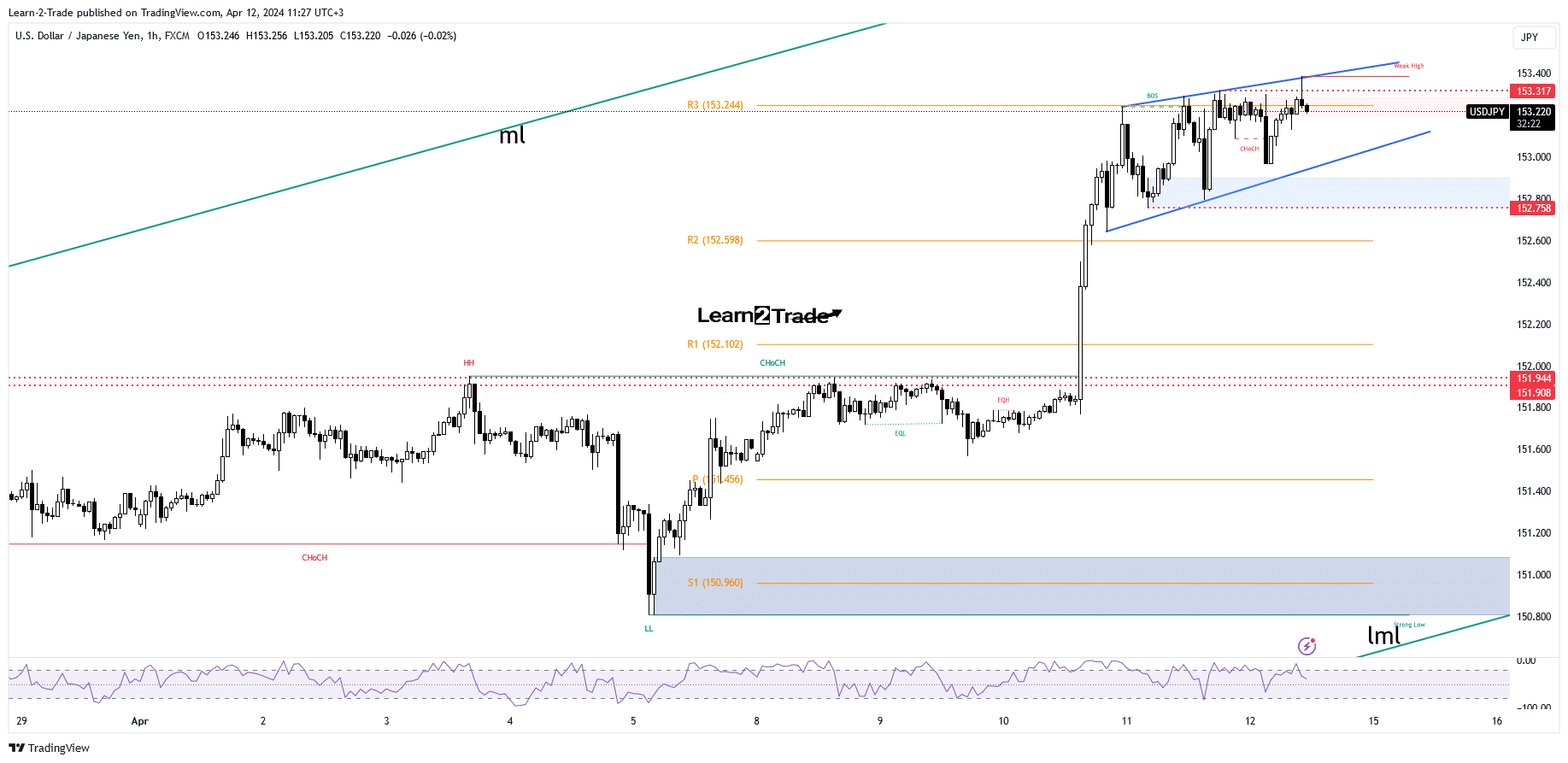

- Bias remains bullish despite minor dips.

- The bear formation is far from confirmed.

- A new lower low activates a corrective phase.

The price of USD/JPI rose to 153.38 today, marking a new high. Now the pair has pulled back a bit and is trading at 153.23 at the time of writing. Bias remains bullish despite minor pullbacks.

–Are you interested in learning more about buying NFT tokens? Check out our detailed guide-

Dollar gains strongly after US inflation data weakens Japanese yen. The currency pair remains higher even though the PPI reported a rise of just 0.2% versus an estimate of 0.3%, while the Core PPI rose 0.2% as expected.

The US dollar only got a helping hand from unemployment claims. The indicator reached 211 thousand, compared to the estimated 216 thousand.

Today, the yen was hit by Japan’s revised industrial production, which reported a 0.6% decline, higher than forecasts for a 0.1% decline.

Later, US economic data could revive the USD/JPI pair. Prelim UoM Consumer Sentiment may fall from 79.4 points to 79.0 points, which could be bad for the dollar. Data on inflation expectations in UoM and import prices will also be published.

USD/JPI price technical analysis: Strong resistance at 153.50

The price of USD/JPI continues to challenge the weekly R3 of 153.24. It stands as static resistance. The former high of 153.31 also represents an upside barrier. As you can see on the hourly chart, the price action has developed a potential bullish wedge pattern. However, this formation is far from confirmed.

–Are you interested in learning more about the UK Trading Platform overview? Check out our detailed guide-

The bias is bullish as long as it remains above the minor uptrend line and the previous low of 152.75. Therefore, further growth is favorable. Only a new lower low, falling and closing below 152.75, could trigger a larger correction.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.