- Bias remains bullish as DKSI rallies.

- A new lower low triggers a sell-off.

- The FOMC is considered the most important event of the week.

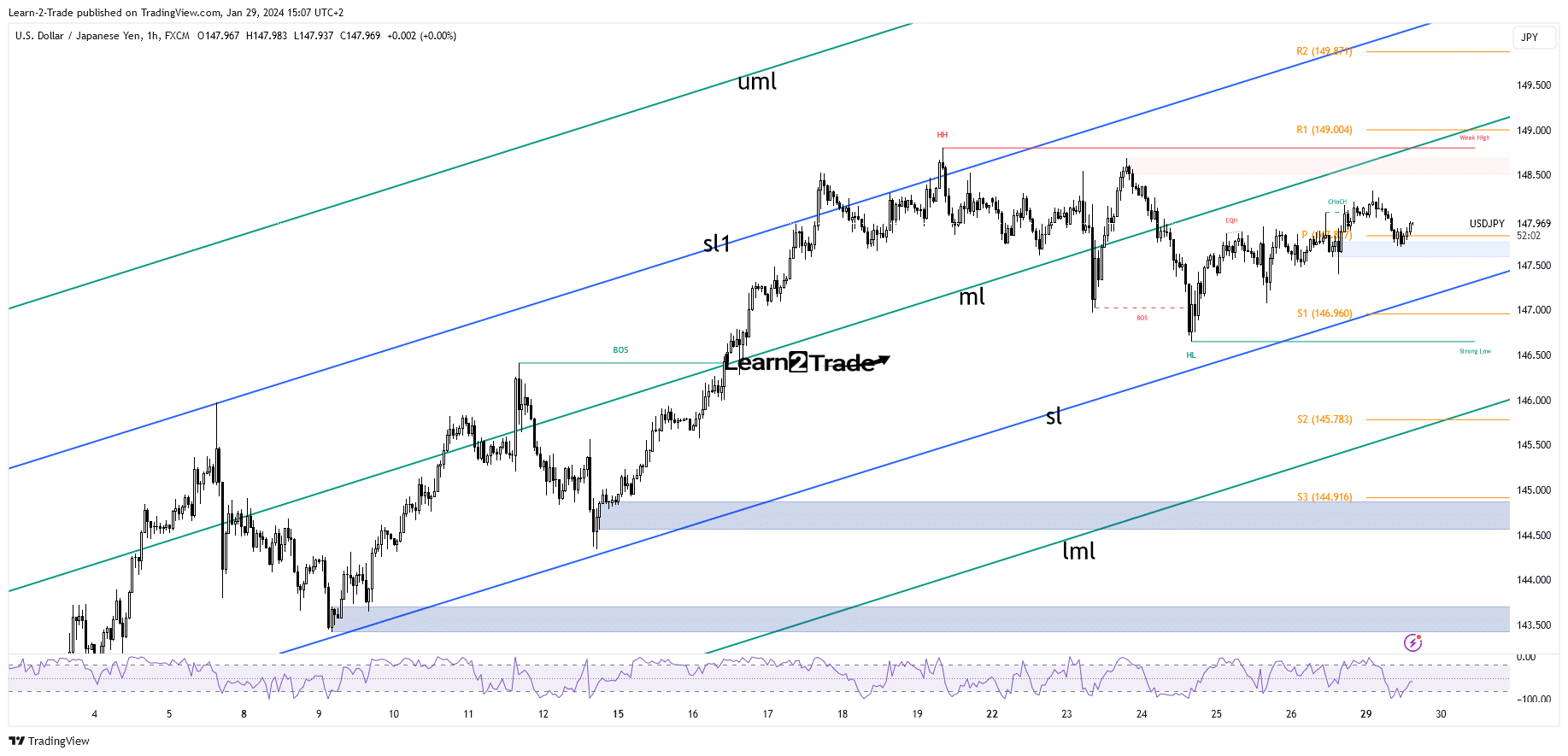

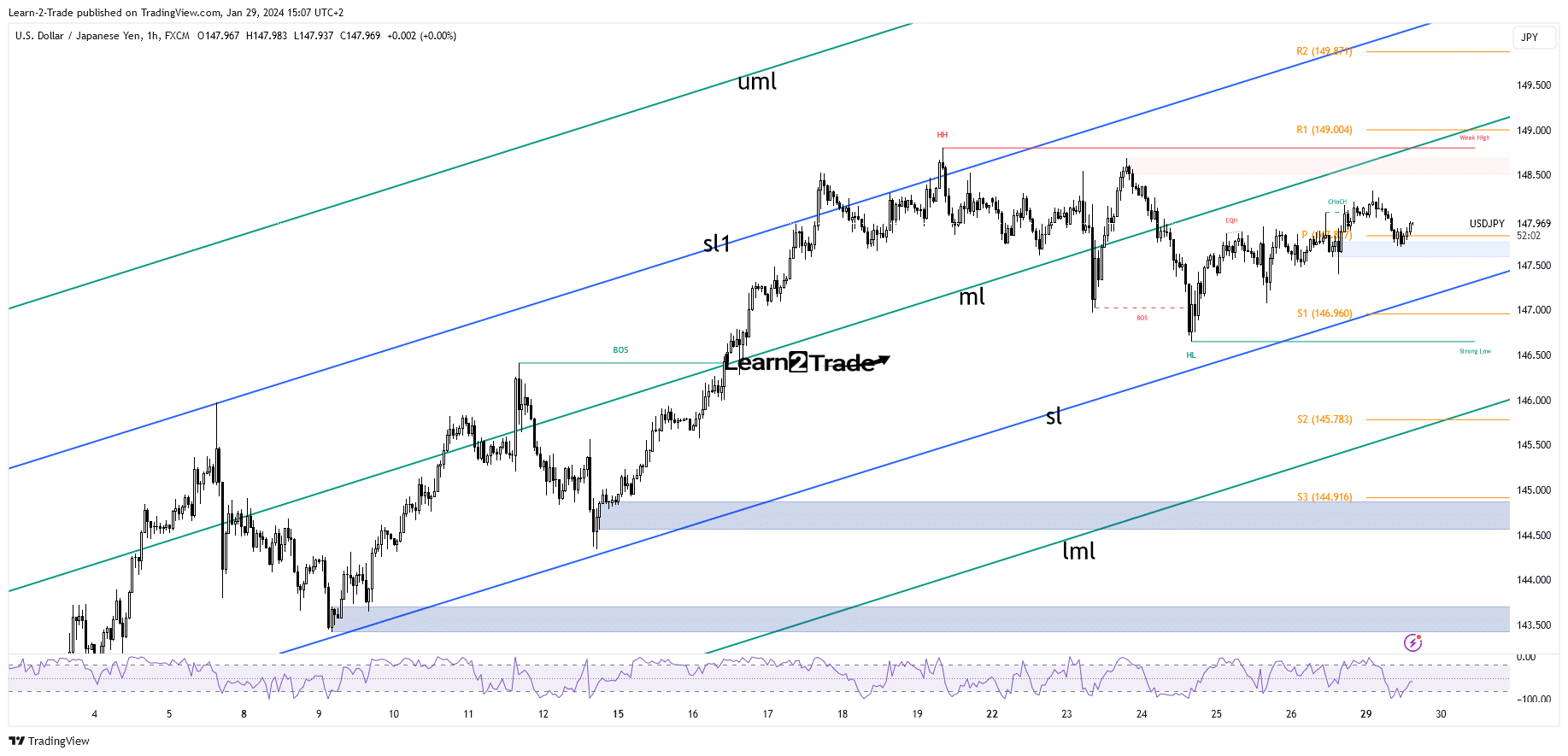

USD/JPY remains bullish despite minor pullbacks. The pair is trading at 147.98 at the time of writing and is struggling to extend its rally due to a lack of dollar conviction. Further growth in the Greenback should help the pair gain significant traction.

–Are you interested in learning more about ETF brokers? Check out our detailed guide-

Japan’s Tokyo Core CPI came in worse than expected on Friday, while the SPPI matched expectations. On the other hand, pending home sales and personal consumption in the US beat expectations, while personal income and the core PCE price index were in line with expectations.

Today, the price could be affected by technical factors because we do not have significant economic events. Japan’s unemployment rate could remain stable at 2.5% tomorrow.

The US will release high impact data such as CB Consumer Confidence which is expected to jump from 110.7 to 113.9 points, and JOLTS Job Openings. The FOMC is the most important event of the week. The Fed is expected to keep benchmark interest rates on hold on Wednesday, but the FOMC press conference could cause volatility.

USD/JPI Price Technical Analysis: Retracement Attempt 148.00

From a technical point of view, the price of USD/JPI turned upside in the short term, erasing some of the previous losses. However, the recovery could only be temporary as the price could only retest the current supply zones or resistance levels before falling.

–Are you interested in learning more about Canadian forex brokers? Check out our detailed guide-

The pair remains trapped between the internal sliding lines (fig, fig1). Its failure to retest the median line (ml) signaled exhausted buyers. A bounce can represent a flag pattern, signaling a new leg down.

A break back below the weekly pivot point of 147.82 and the creation of a new lower low activates a new sell against the sliding line (fig).

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money