- Investors increased bets on a BoJ rate hike next week.

- US GDP data for Q2 was 2.8%, well above the forecast of 2.0%.

- Investors are waiting for the meetings of the Bank of Japan and the Fed.

The weekly USD/JPI forecast is bearish, with investors increasingly betting on a rate hike by the Bank of Japan at next week’s meeting.

USD/JPI ups and downs

The USD/JPY pair had a bearish week, with the yen finding its feet against the dollar. The yen’s gains came as investors increased bets on a BoJ rate hike at next week’s policy meeting. Optimism over a rate hike kept the dollar at bay despite better-than-expected economic data.

–Are you interested in learning more about Forex robots? Check out our detailed guide-

In particular, business activity in the US rose in June as the services sector expanded. Meanwhile, Q2 GDP data came in at 2.8%, well above the forecast of 2.0%. In addition, US jobless claims fell last week, pointing to a still strong labor market. Finally, the core PCE index came in line with expectations, rising 0.2% m/m.

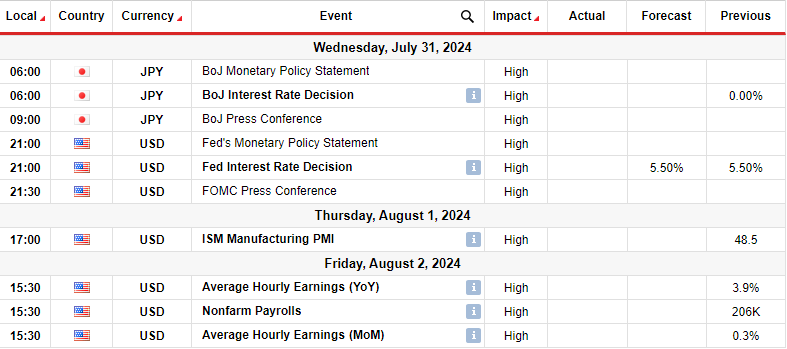

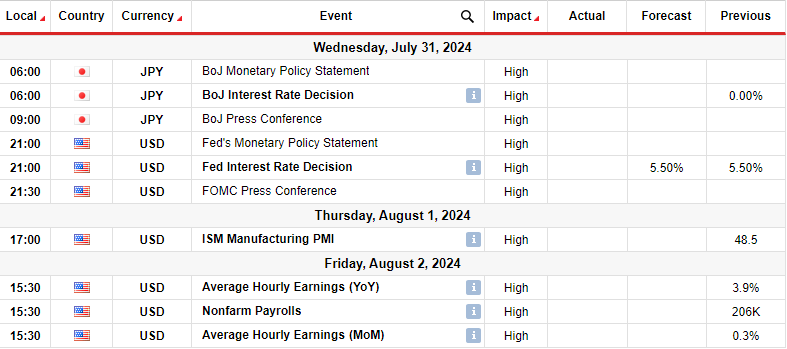

Next week’s key events for USD/JPI

Next week, USD/JPI will see a lot of volatility with the Bank of Japan and Fed meetings. At the same time, the US will release key data on production and employment. Notably, there is a 67.2% chance that the BoJ will raise rates by 10 bps next week. If that happens, the Yen could strengthen, pushing USD/JPI lower.

Meanwhile, the Fed is likely to keep rates unchanged. However, given the recent decline in inflation, policymakers may take a more dovish view.

Elsewhere, the US non-farm payrolls report will continue to shape the outlook for a Fed rate cut. The easing of the labor market will give policymakers more confidence to cut in September.

USD/JPI weekly technical forecast: signals a strong downtrend

On the technical side, the USD/JPY price has broken below its bullish trendline and is approaching the 152.01 support level. Furthermore, the RSI has crossed below 50, indicating a change in bearish sentiment.

–Are you interested in learning more about KSRP price forecasting? Check out our detailed guide-

The price has been in an uptrend for a long time with higher highs and lows. However, this changed when the price broke below the previous low to make a lower low. There is a good chance it will also make a lower high next week. A downtrend would allow the bears to retest the 152.01 and 146.50 support levels.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.