- US retail sales beat forecasts and rose 0.7% in March.

- Fed officials have become more cautious about the timing of rate cuts.

- Ueda said the BoJ will raise rates if the weakening yen leads to high inflation.

The weekly USD/JPI forecast is bullish, fueled by positive US data and fading expectations for a Fed rate cut.

USD/JPI ups and downs

The USD/JPI pair had a bullish week characterized by dollar strength. The dollar had another strong week as interest rate cut expectations fell on upbeat data and hawkish remarks from the Fed. Notably, US retail sales beat forecasts and rose 0.7% in March. This was accompanied by hot inflation and job numbers, indicating a strong economy. As a result, Fed officials have become more cautious about the timing of rate cuts. Powell avoided giving guidance, noting that high rates could remain for longer.

-Are you looking for automated trading? Check out our detailed guide-

Meanwhile, Japanese authorities have continued to issue verbal warnings against a falling yen. Ueda even said the BoJ would raise rates if a weaker yen led to higher inflation. Notably, the yen rallied briefly on Friday on safe-haven demand amid escalating Middle East tensions.

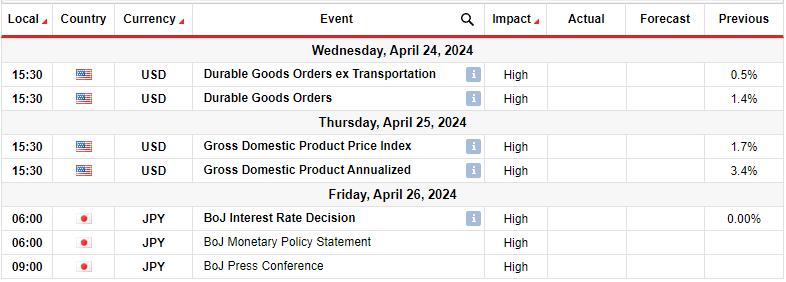

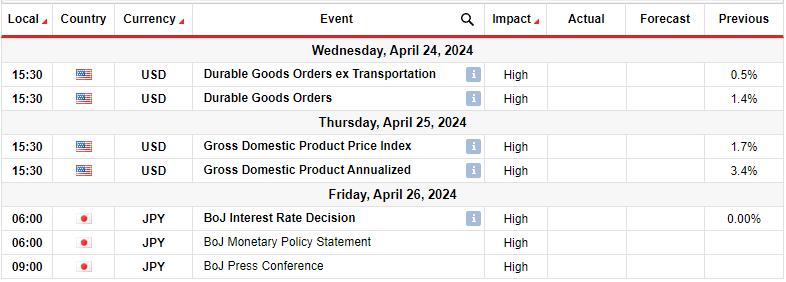

Next week’s key events for USD/JPI

Next week, the US will release data on durable goods and economic growth. At the same time, investors will focus on the Bank of Japan’s monetary policy meeting. Core durable goods orders from the US will show the state of demand in the economy, which affects the Fed’s rate cut prospects. Strong demand will make the Fed cautious about cutting rates too soon. Furthermore, the GDP report will show whether the economy has expanded. Given the resilience of the economy, there is a good chance the numbers will be positive.

Finally, traders are eagerly awaiting the BoJ’s policy meeting after Kazuo Ueda signaled a possible rate hike.

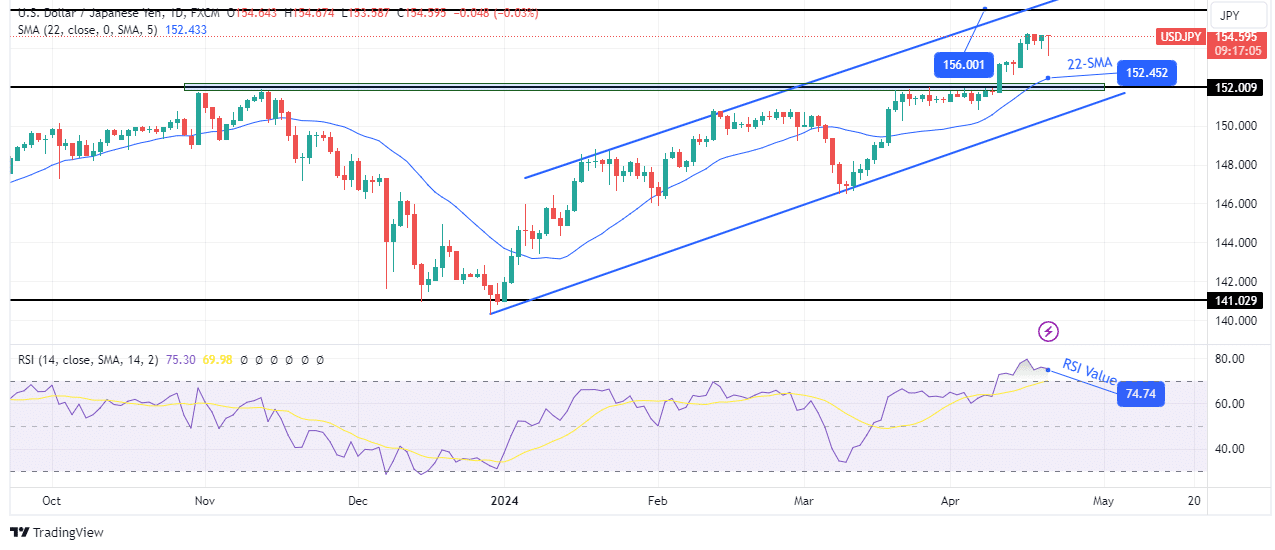

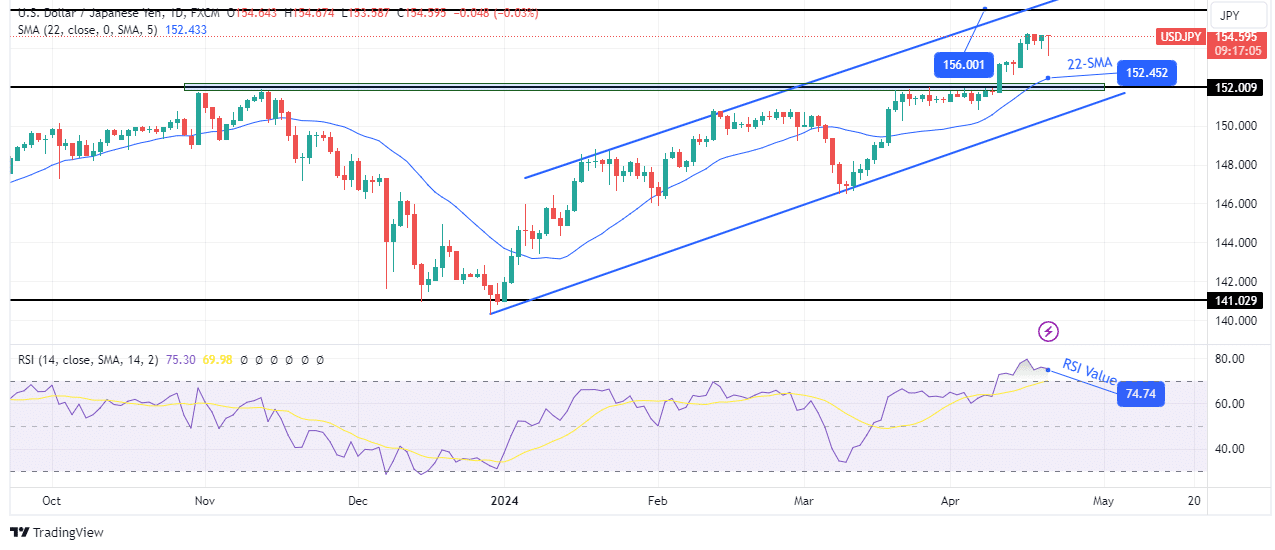

USD/JPI Weekly Technical Forecast: Bulls target 156.00 level, channel resistance

On the technical side, the price of USD/JPI is rising sharply after breaking above the key level of 152.00. The price has long been caught in a tight consolidation below this level. However, the bullish momentum grew when it finally broke above.

–Are you interested in learning more about STP brokers? Check out our detailed guide-

At the same time, the price is approaching the resistance line of its bullish channel, where it could reverse. This could mean a retest of the critical resistance level of 156.00. However, the RSI is in overbought territory, indicating near-maximum bullish momentum. If the bulls are exhausted soon, the price could reverse, break below the 22-SMA and target the support line of the channel.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money