- The dollar strengthened amid upbeat data from the US.

- The yen weakened as investors lost hope of the BoJ turning to higher interest rates.

- Inflation in Japan slowed for a second month.

The weekly USD/JPI forecast reveals a bullish outlook as a resilient US economy lifts the greenback to new highs. On the downside, the yen faces headwinds as the Bank of Japan leans towards a more dovish stance.

-Are you interested in learning more about the Forex Signal Telegram Group? Click here for details –

USD/JPI ups and downs

USD/JPI had a very bullish week as the dollar strengthened amid upbeat US data. Meanwhile, the yen weakened as investors lost hope of the BoJ’s move to raise interest rates.

In particular, data on retail sales and the labor market pointed to the strength of the US economy. Retail sales rose more than expected, while initial jobless claims fell significantly.

Meanwhile, in Japan, inflation slowed for a second month, reinforcing expectations that the BoJ will maintain its dovish stance.

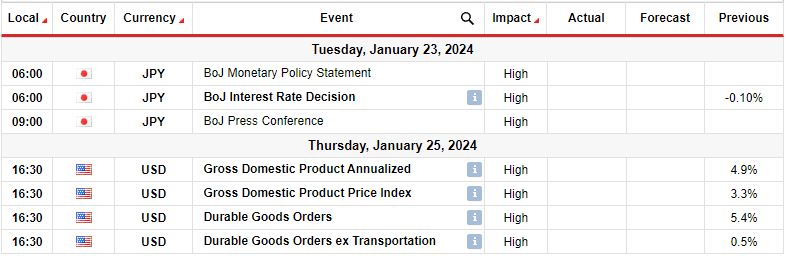

Next week’s key events for USD/JPI

Next week, traders will pay attention to the BoJ policy meeting in Japan. Meanwhile, the US will release data on GDP and core durable goods orders. The Bank of Japan is expected to maintain its ultra-loose monetary policy. The focus will be on any hints Governor Kazuo Ueda gives about the central bank’s plan to lift short-term interest rates out of negative territory.

Market expectations point to a potential rate hike in March or April as policymakers work to keep inflation at the BOJ’s 2% target.

On the other hand, data from the US will show the current state of the economy as investors speculate on the timing of a Fed rate cut.

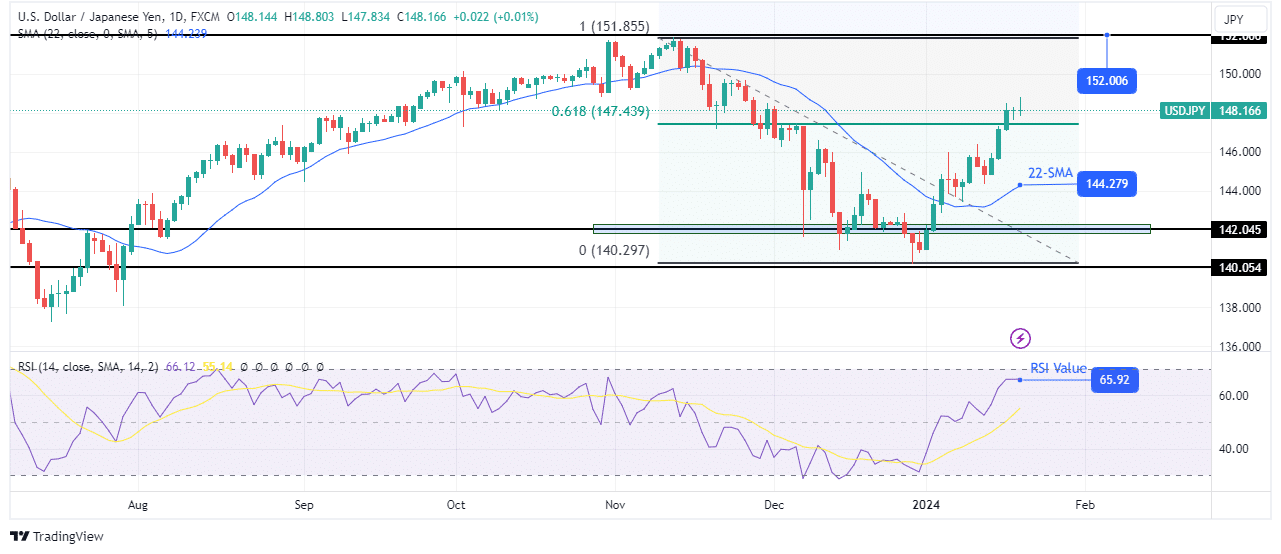

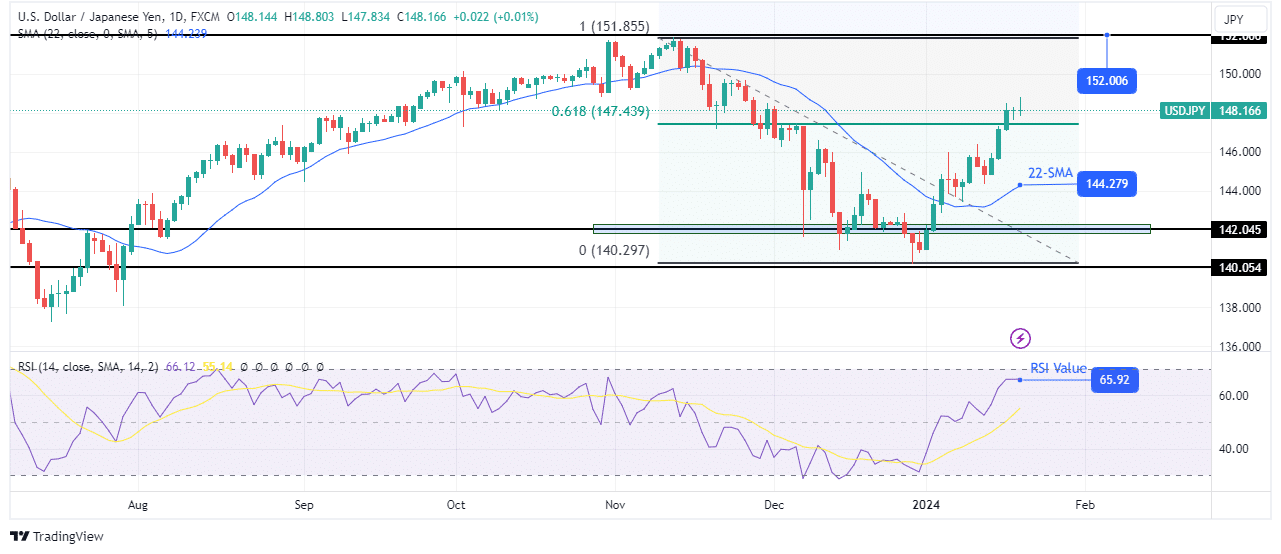

USD/JPI weekly technical forecast: Bullish bias strengthens with break above 0.618 fib

The bullish bias for USD/JPI strengthened as the price broke above the key fib level of 0.618. As a result, the price is now well above the 22-SMA, with the RSI just below the overbought region. The bulls have been in the lead since the price touched and reversed from the 140.05 support level.

–Are you interested in learning more about forex earnings? Check out our detailed guide-

After breaking the fib level of 0.618, a steep, bullish move targets the next resistance at 152.00. However, before it gets there, price is likely to pause or pull back to retest the 22-SMA. However, the bullish move will continue if the price remains above the SMA and RSI above 50.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.