- Inflation data from the US supported investors’ expectations of an upcoming interest rate cut.

- Powell said the rate hike cycle is likely coming to an end.

- Economists do not foresee any changes at the upcoming BOJ meeting.

In the USD/JPI weekly forecast, the winds of change are shifting towards a bearish outlook. This trend comes as Federal Reserve policy takes a dovish turn, while the BoJ outlook takes a somewhat hawkish turn.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

USD/JPI ups and downs

USD/JPY ended the week in the red as the dollar weakened after the FOMC meeting. Moreover, inflation data from the US supported investors’ expectations of an upcoming rate cut. At the FOMC meeting, Powell said the rate hike cycle is likely coming to an end. This opens the door for a rate cut in 2024.

In addition, investors speculated about an end to negative interest rates in Japan. This helped the yen gain against the dollar. However, no changes are expected at the BoJ’s policy meeting next week.

Next week’s key events for USD/JPI

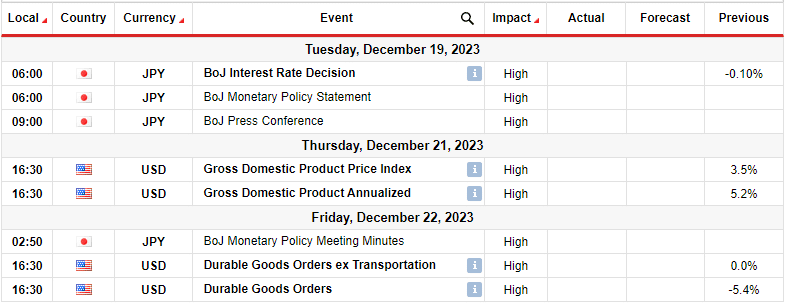

The BOJ will meet next week, and investors do not expect policy changes. More than 20 percent of economists in a Reuters poll predict the Bank of Japan will start tapering its ultra-loose monetary measures in January. However, none of the economists in the survey foresees changes at the upcoming meeting.

Furthermore, durable goods orders and gross domestic product from the US will show the state of the economy. As such, these reports will affect bets on a Fed rate cut.

USD/JPI weekly technical forecast: Bears unravel recent bullish run

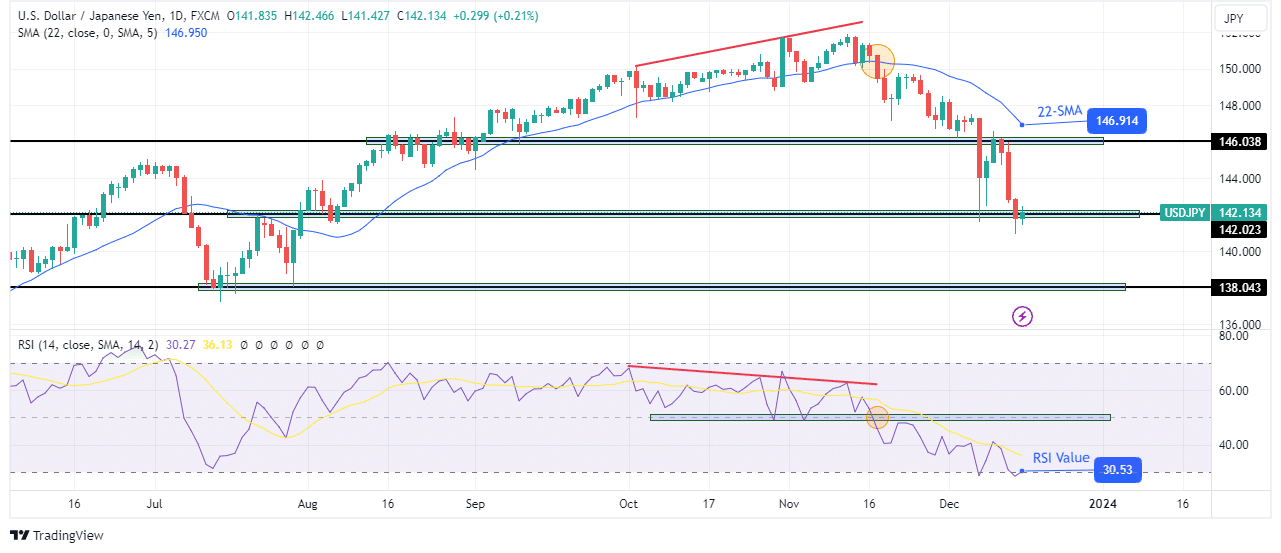

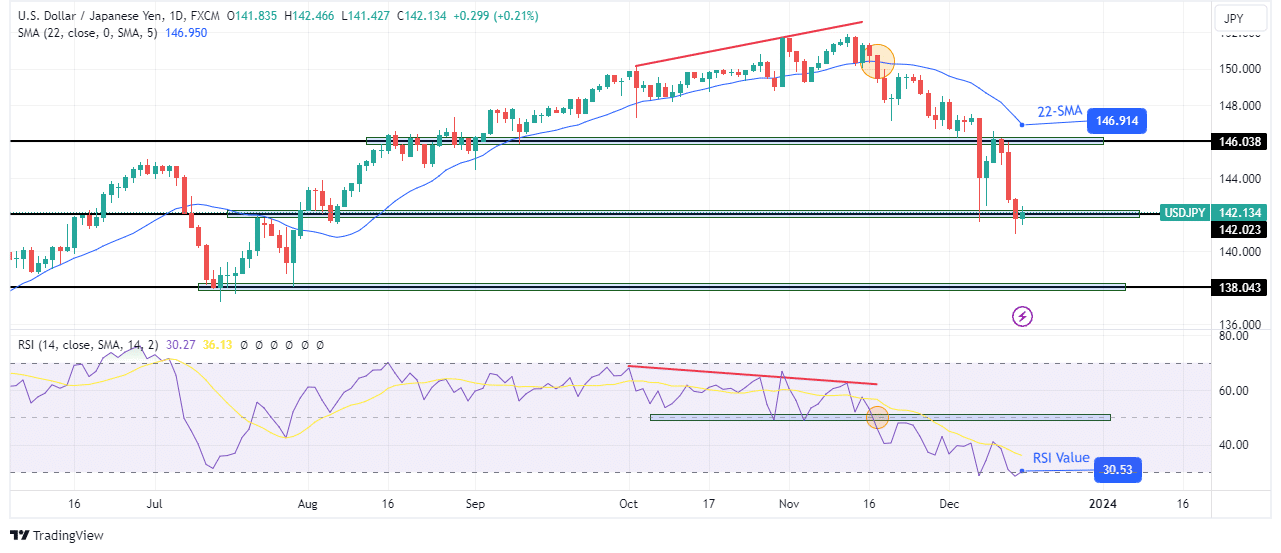

USD/JPI has returned to much of its recent bullish run after the bears took control by breaking below the 22-SMA. The shift to bearish sentiment came after bullish momentum weakened with a bearish RSI divergence. Therefore, the bears were finally strong enough to break through the 22-SMA resistance. At the same time, the RSI has crossed below 50. Now that the bears are in control, the price is breaking below the support level while holding below the 22-SMA.

–Are you interested in learning more about forex tools? Check out our detailed guide-

The latest support breach was at the 146.03 level. The price broke and retested this level, which now challenges new support at 142.02. If the bears can close below this support, the price will fall to 138.04. However, the price could consolidate if the level holds while the 22-SMA catches up.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.