- The dollar fell on renewed bets on a September Fed rate cut of 50 bps.

- Several Bank of Japan policymakers have sought support for more rate hikes.

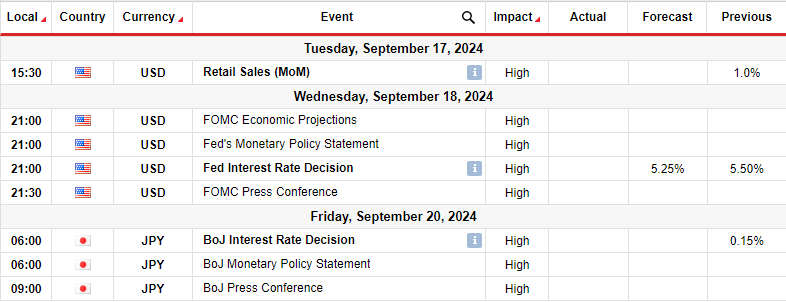

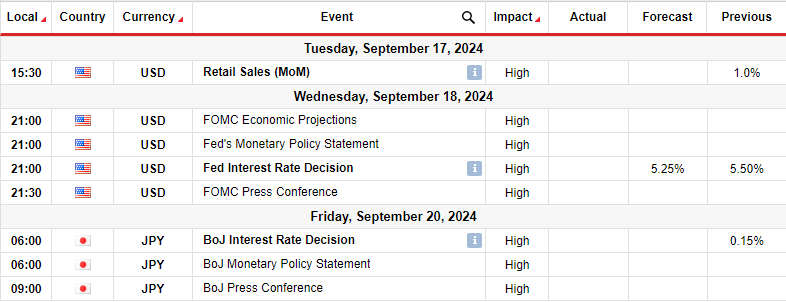

- Investors will focus on the FOMC and BoJ policy meetings.

The weekly USD/JPI forecast points to a potential collapse if the Fed cuts by 50 basis points and the Bank of Japan holds a hawkish meeting.

USD/JPI ups and downs

USD/JPI fell and closed on a bearish candle last week. This came as the dollar collapsed while the yen strengthened. The dollar fell on renewed bets for a 50 basis point rate cut later in the week. Initially, inflation reports indicated a smaller decline.

–Are you interested in learning more about STP brokers? Check out our detailed guide-

On the other hand, the yen strengthened as several Bank of Japan policymakers sought support for more interest rate hikes.

Next week’s key events for USD/JPI

Next week, investors will focus on the FOMC policy meeting and US retail sales data. At the same time, the Bank of Japan will hold a policy meeting on Friday. Investors have been waiting for the September Fed meeting for a long time. The Fed is likely to pivot at this meeting, implementing its first rate cut.

However, investors are not sure whether it will be 25 or 50 basis points. A small rate cut could boost the dollar as it precedes a gradual pace of easing. On the other hand, a big rate cut would sink the dollar.

Meanwhile, the Bank of Japan may keep rates on hold for now. However, economists predict another rate hike before the end of the year.

USD/JPI weekly technical forecast: bullish divergence near 140.07

On the technical side, the USD/JPI price made a new downtrend streak after breaking below the 144.00 support level. Bears have remained in charge since the price broke below the 22/SMA and the RSI fell below 50. Since then, the price has declined sharply and paused near the 140.07 support level.

–Are you interested in learning more about Forex robots? Check out our detailed guide-

However, the bears weakened over time and the price started consolidating near the 22-SMA. At the same time, the RSI made a bullish divergence, indicating a weakening of the bearish momentum. Therefore, the tides could change soon. If the bears fail to break the 140.07 support, the price could reverse to challenge the 22-SMA and the 144.00 level.

A break above the SMA would indicate a change in sentiment. On the other hand, if the SMA holds tight, the downtrend could continue.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money