- The NFP report showed more than expected job growth in May.

- Traders lowered rate expectations, which led to a rise in the dollar.

- Economists expect the headline CPI to remain stable at 3.4%.

The weekly USD/JPI forecast shows renewed bullish momentum as the resilience of the US labor market clouds the prospect of a Fed rate cut.

USD/JPI ups and downs

USD/JPI closed well above its lows as the greenback strengthened following better-than-expected economic data. This week, the yen was mostly at the mercy of the dollar, as Japan had no high-impact events. Meanwhile, the US released several reports earlier in the week that gave the impression that the economy is deteriorating due to high borrowing costs. Accordingly, investors have increased the odds of a Fed rate cut in September to 69%.

–Are you interested in learning more about Ethereum price prediction? Check out our detailed guide-

However, this reversed on Friday when the NFP report showed stronger-than-expected jobs growth. The US added 272,000 jobs in May, well above expectations of 182,000. As a result, traders reduced expectations for a rate cut, which led to a rise in the dollar.

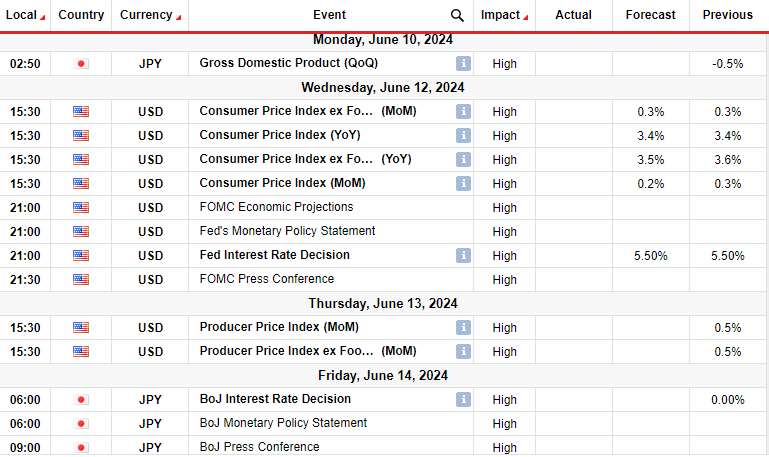

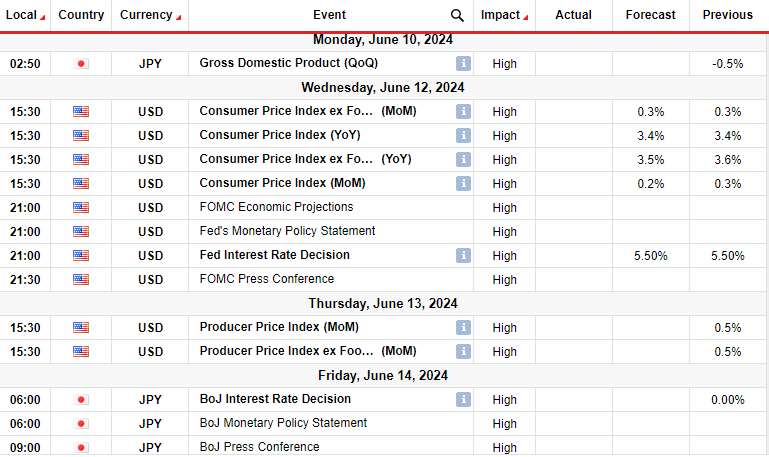

Next week’s key events for USD/JPI

Next week will be packed with high-impact economic events from the US and Japan, which are likely to cause a lot of volatility. The US will release data on consumer and wholesale inflation, shaping the Fed’s rate cut outlook. Economists expect the headline CPI to remain stable at 3.4%. A higher number would indicate persistent inflation and reduce the chances of a rate cut in September. On the other hand, a smaller number would strengthen the case for a rate cut.

Furthermore, investors will focus on the FOMC’s policy meeting to learn whether policymakers are gaining confidence in the fight against inflation. Messages during and after the meeting will carry a lot of weight, especially after the CPI report.

Meanwhile, the Bank of Japan will also hold its policy meeting, which is likely to keep rates unchanged.

USD/JPI Weekly Technical Forecast: Price recovers after solid support trend line

On the technical side, the price of USD/JPI is jumping higher after retesting the solid support trend line. Furthermore, it is on the verge of breaking above the 22-SMA to confirm a change in bullish sentiment. Meanwhile, the RSI is trading just above 50, supporting bullish momentum.

–Are you interested in learning more about Crypto Signals Telegram Groups? Check out our detailed guide-

Therefore, in the coming week, the bulls are likely to challenge the key resistance level of 158.01. A break above this level would confirm the continuation of the bullish trend, allowing the price to cross the 160.00 level to 162.51.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.