- Data on consumer and producer prices in the US revealed a jump in inflation.

- There was optimism that big companies in Japan would raise wages.

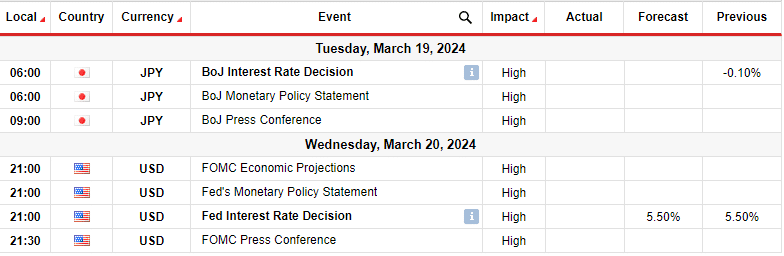

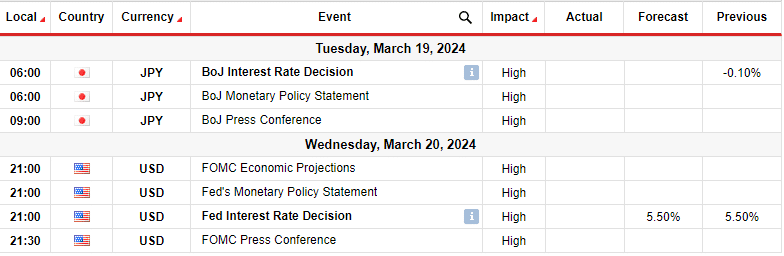

- Investors will pay attention to political decisions in the US and Japan.

The weekly USD/JPI forecast shows upside potential as expectations for a June Fed rate cut ease amid signs of high inflation.

USD/JPI ups and downs

USD/JPI had a bullish week as the dollar strengthened and the yen weakened. The dollar strengthened as data on consumer and producer prices revealed a rise in inflation. As a result, the chances of a Fed rate cut in June have diminished. If the Fed keeps interest rates higher for longer, the dollar will continue to rise, weighing on the yen.

-Are you interested in learning more about Bitcoin price prediction? Click here for details –

Meanwhile, the yen lost some strength as BoJ Governor Kazuo Ueda gave a weak assessment of the economy. However, there was optimism that big companies in Japan would raise wages. The increase in wages will allow the Bank of Japan to start raising interest rates.

Next week’s key events for USD/JPI

Next week, investors will pay attention to political decisions in the US and Japan. There has been a lot of speculation recently about a possible change in policy in Japan. Markets expect the Bank of Japan to start raising interest rates. Moreover, there is a chance the central bank will pivot at next week’s meeting, as companies in Japan are poised to give their workers big wage increases. Higher wages mean better consumer spending, paving the way for higher borrowing costs.

On the other hand, the Fed is likely to keep rates on hold next week. In addition, investors will pay attention to economic projections and the press conference for more clues about rate cuts.

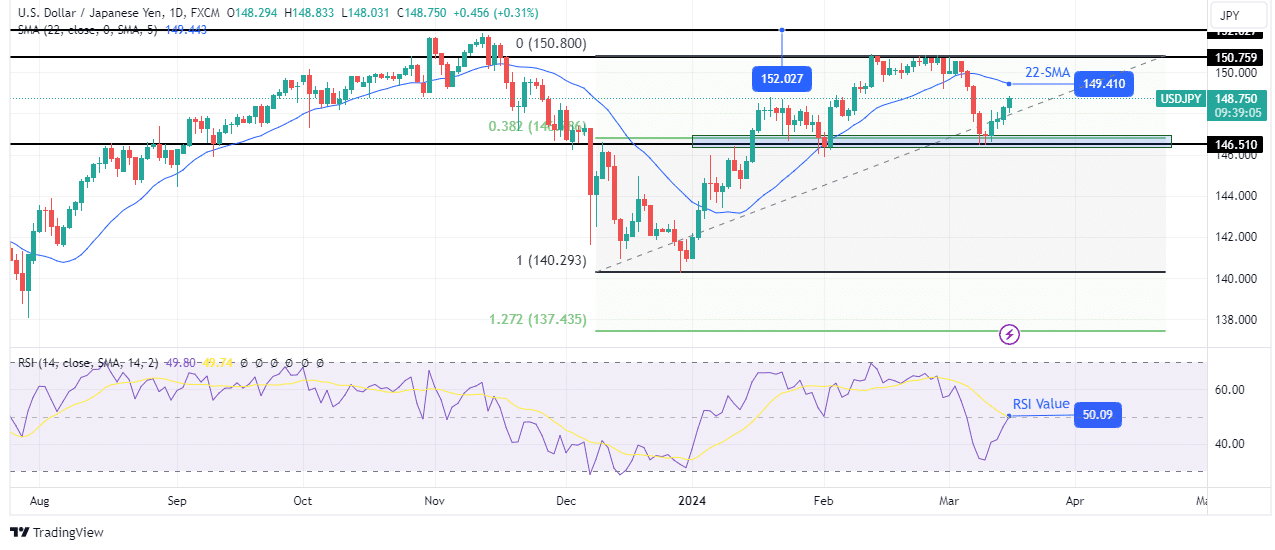

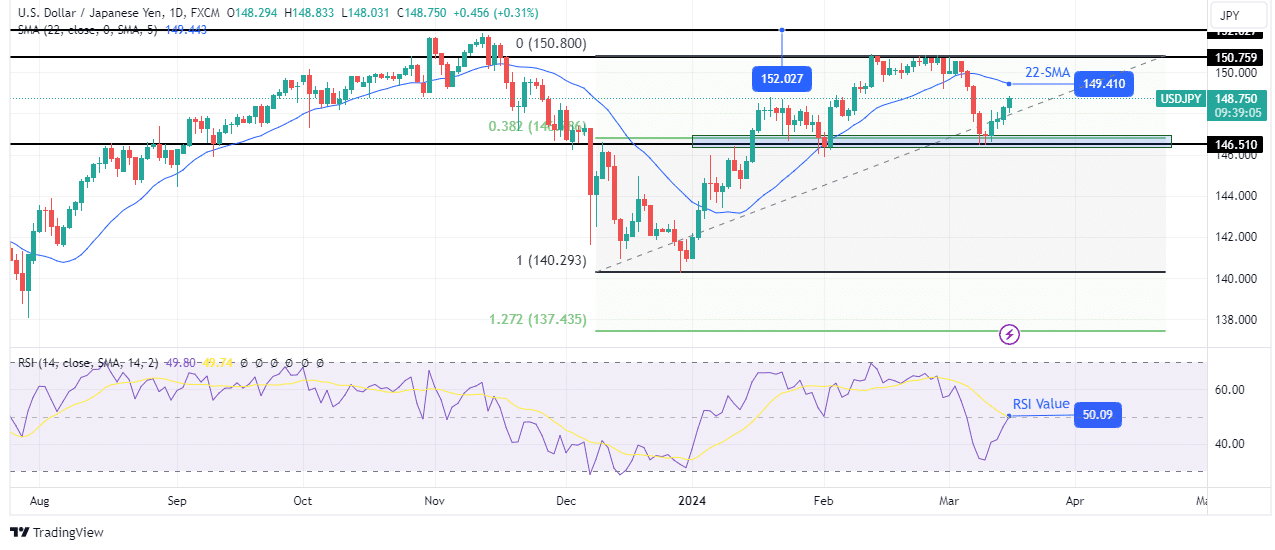

USD/JPI Weekly Technical Forecast: New bearish momentum pauses at 146.51

On the technical side, USD/JPI is climbing after finding support at the key 146.51 level. However, the bias remains bearish as the price is trading below the 22-SMA. On the other hand, the RSI seems poised to trade in bullish territory above 50. However, the bulls will only take over once the price breaks above the 22-SMA and the key resistance level of 150.75. If this happens, the price is likely to retest the key resistance level of 152.02.

-Are you interested in learning more about the Forex Signal Telegram Group? Click here for details –

However, if the trend reverses to the downside, the price will respect the 22-SMA and bounce lower. However, the bears need to make a lower low below 146.51 to further confirm the new bearish trend.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.